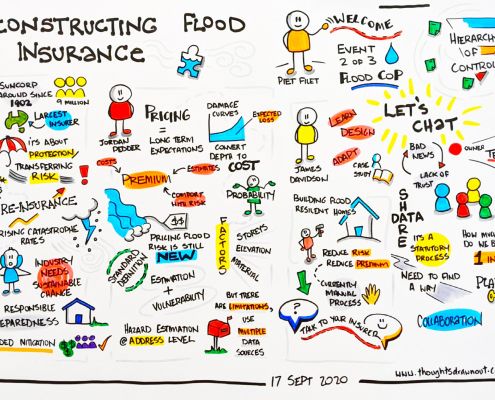

Deconstructing Flood Insurance

Purpose of the workshop

As the second event in a series of Flood CoP workshops to better understanding some key fundamental aspects of flood risk reduction, this event was to showcase the role of Flood Insurance within the mix of other measures needed.

So with the event partners, this was designed to:

- Build an understanding of what and how insurance works;

- Introduce participants to the process by which flood risk is priced into insurance premiums

- Consider case studies of flood risk reduction and what it means for residents of business owners

- Seek feedback from event participants on where they see insurance fitting into the jigsaw of flood risk reduction strategies & measures

We ambitiously offered this as a dual event, with 32 participants at the venue and 42 participants online. Challenges with delays and lost connection, meant we had to be flexible on the delivery. Many thanks to the participants patience as we dealt with this on the fly.

Participants at this event

Across the two groups we had a wide mix of colleagues joining us on 17 September 2020 from:

Local Government – Moreton Bay, Fraser Coast, Gold Coast, Bayside, Logan, Sunshine Coast, Brisbane City Smart, Brisbane,

State Government – QFES, QRA

Consultants – Ethos Urban, Water Technology, Hydrata, Arup, Bligh Tanner, Blue Ocean Connections, Hydrobiology, NCEconomic

Research – Griffith, UC Davies, CRC Water Sensitive Cities, South Pacific Community, QUT

Industry – Munich Re, Westpac, Suncorp, Twohill Project Solutions, Advanced Buildings, Auto & General, Clear Insurance, Floodplain Management Australia, JDA Co,

Education – International WaterCentre,

What is Flood Insurance

Our speaker Joshua Cooney – Executive Manager Government, Industry and Public Policy, Suncorp – provides an excellent overview of the factors and elements involve. To see this video presentation – please click here

Principles of Pricing Insurance

To unpack the various aspects that influence the way an insurance policy is priced, Jordan Pedder – Natural Perils Senior Pricing Advisor at Suncorp – explains what is involved. To see this video – please click this link

Design Options to Reduce Exposure

As a local architect, with a desire to better respond to the impacts of climate change and the risks of households on a floodplain, James Davidson and his team have built up a wealth of design and practical experience in household flood resilience options. In this video below, this need and way to respond is explained.